With the End of the Financial Year for 2023-24 fast approaching, new laws will be enacted come 1 July 2024. We’ve compiled a list of all the changes for individual taxpayers, families and everyone in between.

Tax

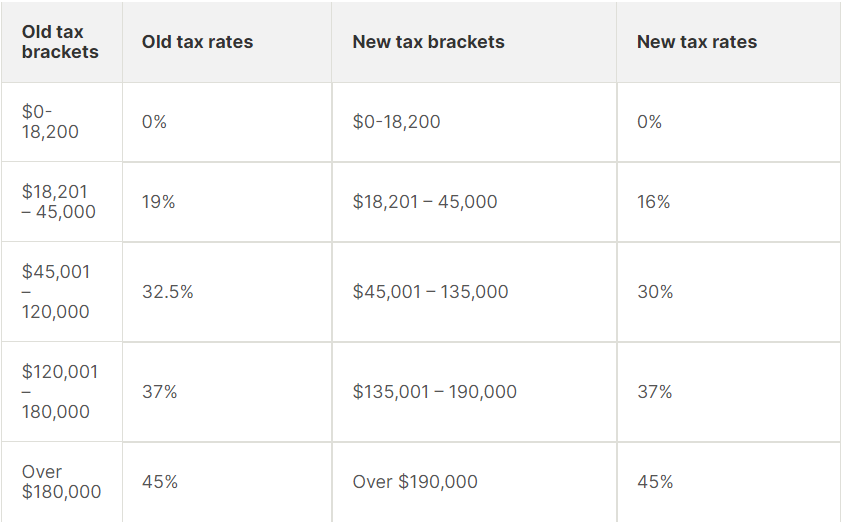

All taxpayers will see a change to their weekly pay when the stage 3 tax cuts, which were the forefront of the government’s federal budget, take effect.

The changes are listed below:

You don’t need to do anything to get the tax cut. Employers will automatically adjust the amount of tax they take out of your pay.

Superannuation

From 1 July 2024, the SG rate which determines the minimum percentage of your salary that your employer must contribute to your super fund, will increase from 11% to 11.5%. the rate will continue to increase until it reaches 12% on 1 July 2025.

The cap on concessional (before-tax) super contributions will increase from $27,500 to $30,000 per year.

The non-concessional (after-tax) super contributions cap will also increase from $110,000 to $120,000 from the 2024-25 financial year.

Wages

The Fair Work Commission announced that the minimum wage and award wages will increase by 3.75 per cent on 1 July 2024. The decision will impact about 2.6 million workers.

The minimum wage will increase to $24.10 per hour or $915.90 per week, based on a 38-hour working week.

Electricity rebates

The $300 energy rebate for households will be automatically applied to bills after July 1. It will be paid in $75 installments each quarter.

Power prices changes will also kick in, with the Australian Energy Regulator revealing that most households and small business customers on standard retail plans will experience price reductions.

Households could see price reductions between 1 and 6 per cent, depending on their region. Meanwhile, Victorian residential customers will see an average reduction of 6 per cent.

Parental Leave Pay

Parental Leave Pay will be expanded to 22 weeks, up from 20 weeks. Payments are made at the national minimum wage. The amount of leave parents can claim will increase by two weeks until it reaches 26 weeks from July 2026.

This amount is shared between parents. Currently, two weeks of leave are set aside for the second parent who is not using the majority of leave.

If you need more information or have any questions about what’s changing on 1 July 2024, contact our team! We’re here to help you understand all the upcoming changes and how it affects you.

Contact our team today:

hello@mksgroup.com.au

Read More Blogs

6 Tips for Small Business Owners Preparing for the Christmas period

Everything You Need to Know About Your Work From Home Deductions

If you worked from home during the 2024 financial year, this blog is for you!…

3 Ways to Reduce Business Expenses Without Sacrificing Quality

In the dynamic world of small business, maintaining a lean operation without compromising on quality…

All The Changes Coming 1 July 2024

With the End of the Financial Year for 2023-24 fast approaching, new laws will be…

4 Reasons Why Outsourcing Payroll Can Save You Time and Money

Managing payroll can be a complex and time-consuming task for any business owner, especially for…

5 Essential Steps When Preparing to Sell Your Business

When the time comes to sell your business, the journey from decision to deal can…