July 1 is a very important day, changes with super guarantee and single touch payroll (STP) means you and your business must be prepared.

Superannuation Guarantee Increase

Employers, now is the time to prepare for a big change impacting you and your employees. From 1 July 2021, superannuation guarantee (SG) will increase from 9.5% to 10%. Employers should now be reviewing their payroll systems and settings, as well as how employees are remunerated in line with their employment contracts.

In a recent Tax & Super Australia (TSA) article by tax counsel John Jeffreys, he stressed that employers need to give immediate attention to how they will manage the increase in superannuation guarantee. The article outlines that choosing to underpay, pay late, or even not pay at all is not an option. Penalties for choosing not to action are substantial. John Jeffreys states “We haven’t had guidance from the ATO about any grace period or lenience for employers who don’t meet this new SG obligation.” Therefore, it would be prudent to be prepared.

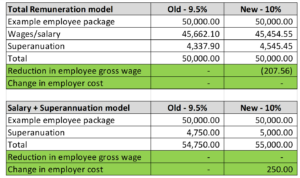

The main question employers need to ask is – Do my employee contracts state a total remuneration package or a salary plus superannuation amount? Here is a simple example of each.

With limited time remaining to the 1st of July, employers should act now as part of their year end payroll process to ensure that they remain compliant with their obligations. Note the increase in the superannuation guarantee amount will be for wages and salaries paid on or after 1 July 2021.

We encourage employers to review employees who salary sacrifice additional contributions to their superannuation fund. The increase may impact their overall position with regards to contribution caps.

How employers manage the increase in superannuation guarantee may depend on how it will impact their bottom line. Regardless of their approach, John Jeffreys said that employers should communicate clearly with employees so they know what to expect on their payslip. “While the policy of the legislation is for the employer to contribute the extra half a percent without impacting take home wages, this may not be the case across all workplaces.”

“As well as considering how much room they have within their profit margins, business products or activities to best cater for this increase, employers should keep in mind that this is not a one-off increase. They’ll need to prepare for the SG to go up 0.5% annually until it reaches 12% in 2025.”

A final point to keep note of is new concessional contribution caps will apply from 1 July 2021, increasing from $25,000 to $27,500.

More information regarding the time frame for changes to the SG amounts can be found here https://www.ato.gov.au/rates/key-superannuation-rates-and-thresholds/?anchor=Superguaranteepercentage

You can find below the link to the full article by John Jeffery’s, 11 May 2021, Tax & Super Australia, Employers must be ready for super guarantee increase or risk penalties

If you have any questions or need help, the team at MKS Group are always available and you can call on 03 93748400 or email an enquiry at hello@mksgroup.com.au

Single Touch Payroll and Closely Held Payees.

With the introduction of Single Touch Payroll (STP), Small employers (19 or fewer payees) were exempt from reporting amounts paid to closely held payees. However, the extension period will now cease from 1 July 2021. All amounts paid to closely held payees will need to be reported through STP. Small employers can choose to report these amounts on or before payday or quarterly.

If you have any other payees (also known as arm’s length employees) they must be reported on or before each payday. Different arrangements apply for businesses with 20 or more payees.

STP reporting for closely held payees

A closely held payee is an individual directly related to the entity from which they receive payments.

For example:

- family members of a family business

- directors or shareholders of a company

- beneficiaries of a trust.

You must continue to report information about all of your other employees (known as arm’s length employees) via STP on or before each payday (the statutory due date). If you only have closely held payees, you are not required to start STP reporting until 1 July 2021. You do not need to tell the ATO that you only have closely held payees.

Ways to report amounts paid to your closely held payees

From 1 July 2021, amounts paid to closely held payees can be reported through STP in any of the following ways:

- Report actual payments on or before the date of payment – whenever you make a payment to a closely held payee, report the information on or before each pay event.

- Report actual payments quarterly – when your activity statement is due, report all payments made in that quarter.

Contact the team at MKS Group to find out which report is right for you.

What you need to report

Like STP reporting for arm’s length employees, the quarterly STP report for your closely held payees must include:

- year-to-date amounts, up to and including the last day of the quarter, for each closely held payee who received a payment subject to withholding that is required to be reported via STP

- the payee’s ordinary times earnings (OTE) or your superannuation liability for the payee

- your total gross wages for payments being reported – same as the W1 label on your activity statement

- your total PAYG withholding payments being reported – same as the W2 label on your activity statement.

How to lodge the quarterly STP report

You must lodge your STP report for closely held payees through an STP-enabled solution, the same as you would for arm’s length employees. You can either lodge the report yourself or have your registered agent lodge it on your behalf.

Depending on your STP reporting solution, your report may include both your arm’s length employees and your closely held payees.

The STP report cannot be lodged through ATO portals. It is not an additional label on your activity statement.

If you currently do not have an STP-enabled solution, we recommend using Xero. Contact our team now to assist you with a solution for STP. If you currently use a different payroll provider, get in touch with them to see how they offer reporting for closely held payees.

When to lodge quarterly STP reports

If you choose the quarterly reporting option, your quarterly STP report is due on or before the due date for your quarterly activity statements. This includes concessions that may apply to your circumstances.

If you report your PAYG withholding on monthly activity statements, your quarterly STP report including amounts paid to your closely held payees is due on the same day as your activity statement for the final month of the quarter.

Choosing a quarterly option does not change the due date for:

- reporting and paying your PAYG withholding on your activity statement

- making SG contributions for your closely held payees.

A reminder – you must continue to report information about your arm’s length employees via STP on or before payday.

For more information or assistance please contact us: (03) 9374 8400